Bank of America Wire Transfer Form 2002-2026

What is the Bank Of America Wire Transfer Form

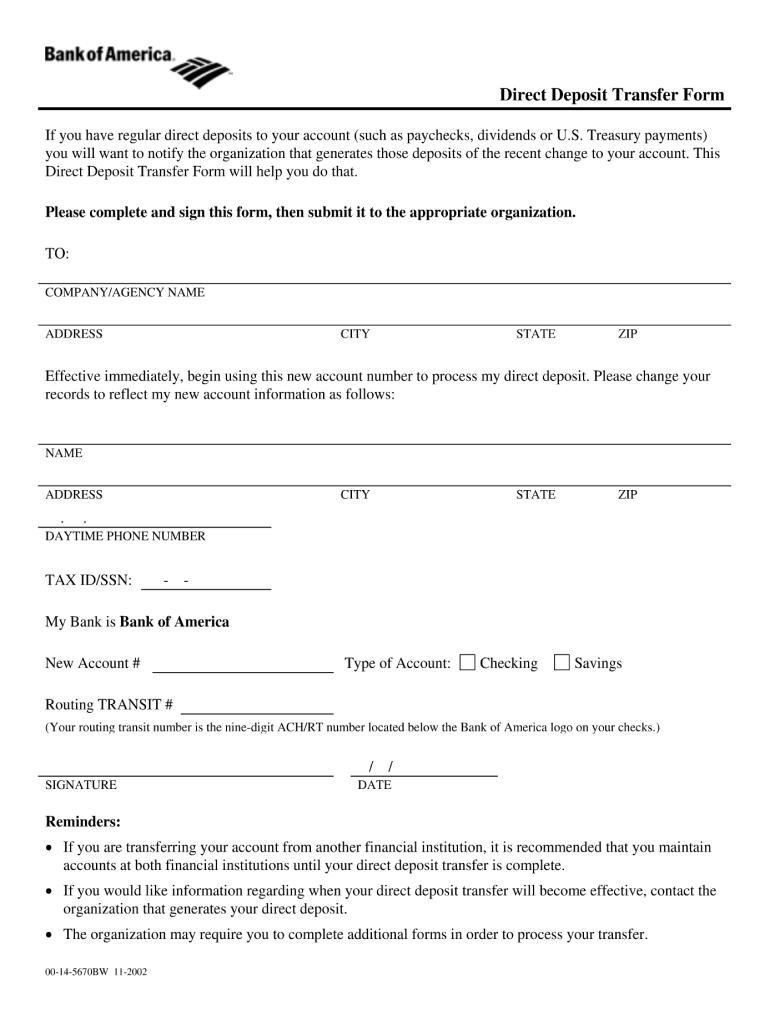

The Bank Of America wire transfer form is a crucial document used to facilitate the electronic transfer of funds between bank accounts. This form allows individuals and businesses to send money domestically or internationally. It typically includes essential details such as the sender's and recipient's names, account numbers, and the amount to be transferred. Understanding the purpose of this form is vital for ensuring accurate and secure transactions.

How to use the Bank Of America Wire Transfer Form

To use the Bank Of America wire transfer form, start by gathering all necessary information, including the recipient's bank details and your account information. Next, access the form either online or through your local Bank Of America branch. Fill in the required fields carefully, ensuring accuracy to avoid delays. Once completed, submit the form electronically or in person, depending on your preference. It is advisable to keep a copy for your records.

Steps to complete the Bank Of America Wire Transfer Form

Completing the Bank Of America wire transfer form involves several key steps:

- Gather necessary information: Collect details such as the recipient's name, bank account number, and routing number.

- Access the form: Obtain the wire transfer form from the Bank Of America website or branch.

- Fill out the form: Enter all required information accurately, including the amount and purpose of the transfer.

- Review the information: Double-check all entries for accuracy to prevent errors.

- Submit the form: Depending on your choice, submit it online or in person at a branch.

Key elements of the Bank Of America Wire Transfer Form

The Bank Of America wire transfer form contains several key elements that are essential for processing the transfer:

- Sender Information: Name, address, and account number of the person initiating the transfer.

- Recipient Information: Name, address, and bank account details of the recipient.

- Transfer Amount: The total amount of money being sent.

- Transfer Purpose: A brief description of why the funds are being transferred.

- Signature: The sender's signature to authorize the transaction.

Legal use of the Bank Of America Wire Transfer Form

The legal use of the Bank Of America wire transfer form is governed by various regulations to ensure secure and compliant transactions. It is essential to understand that all information provided must be accurate and truthful. Misrepresentation or fraudulent activity can lead to legal consequences, including penalties or criminal charges. Additionally, the use of electronic signatures on the form is recognized under U.S. law, provided that the form adheres to regulations such as the ESIGN Act and UETA.

Form Submission Methods

The Bank Of America wire transfer form can be submitted through various methods, allowing for flexibility based on user preference:

- Online Submission: Complete and submit the form through the Bank Of America online banking platform.

- In-Person Submission: Visit a local Bank Of America branch to submit the form directly to a representative.

- Mail Submission: In some cases, you may be able to mail the completed form to the bank, though this method may not be as common.

Quick guide on how to complete bank of america transfer form

The simplest method to locate and sign Bank Of America Wire Transfer Form

On a company-wide scale, ineffective procedures surrounding paper authorizations can consume a signNow amount of work hours. Signing documents such as Bank Of America Wire Transfer Form is a normal aspect of operations in any organization, which is why the efficiency of each contract’s lifecycle greatly impacts the overall performance of the business. With airSlate SignNow, signing your Bank Of America Wire Transfer Form is as simple and quick as possible. You will discover on this platform the most recent version of virtually any form. Even better, you can sign it instantly without needing to install external software on your computer or print out physical copies.

How to access and sign your Bank Of America Wire Transfer Form

- Browse our collection by category or utilize the search bar to find the necessary form.

- Check the form preview by clicking Learn more to confirm it’s the correct one.

- Click Get form to begin editing immediately.

- Fill out your form and include any required details using the toolbar.

- Once finished, click the Sign tool to sign your Bank Of America Wire Transfer Form.

- Choose the signature method that suits you best: Draw, Generate initials, or upload a photo of your handwritten signature.

- Click Done to complete editing and move on to document-sharing options as needed.

With airSlate SignNow, you possess everything necessary to handle your paperwork efficiently. You can find, complete, modify, and even send your Bank Of America Wire Transfer Form in one tab with no difficulty. Enhance your processes with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

When you started investing in Bitcoin back in 2011, what were some of the key elements/reasons that convinced you that was a good investment?

I started investing in Bitcoin way back in early 2013 when it was around $100.I saw value in Bitcoin because it solved a real problem for me. I was living in the US and I was genuinely annoyed with how much time it took to transfer money between India and the US. Plus, the transaction fee for Bank of America was too high.Even the rules about how much money could be sent from India seemed totally arbitrary.The amount of paperwork needed to send money from India to here was also crazy. Every time mom sent me some cash from Bangalore, she had to travel to the bank, fill out a form and then wait for one week before the cash showed up on my bank account.The moment I saw that Bitcoin was “digital money”, I immediately saw value and started investing my time, money and effort on it. I intuitively understood how great Bitcoin was.

-

Do banks treat you differently when you make large deposits?

I’m a professional poker player and won an event once for $286,000. So not an obscene amount of money, but more than your typical customer probably walks in and deposits in cash. Which, btw, if you ever come across a quarter million in cash, It’s probably not the brightest idea to just walk into your local bank branch, unannounced, and start handing them stacks of hundreds wrapped up in $10,000 bundles.This was also directly following the big 3 U.S. poker sites facing indictment and being shut down in the U.S. So claiming online gambling winnings was not a good idea given the climate.I entered the bank and approached an open teller’s window, unzipped my Columbia House duffle bag—which had been given to me as a free gift for being suckered into joining their movie club almost a decade before. As I started stacking the money I stacked 7 packs of $10,000 and opened one up as they were also denominated in stacks of $1000 and separated in the middle by a $5,000 band. I told the teller that I’d like to wire $75,000 to the Bellagio Hotel and Casino —I was headed to Vegas that weekend to play in some high stakes games which were running—and proceeded to pull out the necessary information to wire the money. I put the $5,000 on top and took the other $5000 and stuck it in my sport coat pocket so I’d have some walking around money for when I first arrived in Vegas, before I was able to get to the cage to collect my wire.I had lived in Vegas for a number of years, and it wasn’t unheard of for someone to win an amount like this and have it paid out in cash. Uncommon? A little. But certainly not unheard of. Except I wasn’t in Vegas, I was in a local branch in the suburbs of Kansas City. Where apparently a sub 30 year old doesn’t walk in very often with near $300,000 in cash bundled up in a old, blue, Columbia House duffel bag for a deposit.She instantly asked, “Where did you get all this money?” And then, “That’s a lot to send to a casino to gamble with.”To which I thought, “That’s none of your f**king business.”She must have been able to read the disdain on my face as she instantly excused herself and apologized. A couple minutes later when I had the cash all stacked up on the ledge of the teller window with the 75K off to the side and a slip filled out with the information for wiring the money to the Bellagio main cage, a man approached in a suit and tie and asked if I’d like a private room. I told him I didn’t really need one, that the money was all there, had already been counted, and was ready for deposit. I looked around now to notice several bank employees and customers staring at me but quickly looking away and going back to their business as they saw me looking around the bank.Apparently they don’t just take your word for it when you tell them how much it is, even when packaged up in nice, neat, 10K stacks and 50K bundles. The man in the suit and tie introduced himself as the branch manager and informed me that the money would have to be ran through the machine to be counted and to verify none of the bills were counterfeit. He asked me if I wouldn’t mind coming back to his office and waiting where they could discuss some deposit options with me and then offered me some coffee or something to drink as he motioned with his arms the direction to his office.He too asked me where I had gotten the money, and I was very careful not to mention anything about gambling or playing poker as I knew what an apprehensive issue it was in the financial industry at the time. The Wire Act didn’t prevent playing poker online, exactly, it prevented financial institutions from processing gambling transactions. And the Big Three poker sites in the U.S. hadn’t been shut down with their owners indicted for offering poker online, they had been shut down with the owners indicted for purchasing a bank in Utah where they processed the illegal transactions fraudulently under phony business names. So I told him I’d obtained it selling drugs with a smirk.He didn’t find it as funny as I did so I quickly told him I was kidding, then vaguely told him that I had gotten the money from a friend I had a business interest with, and if he checked my account history he would see that large wires and cash deposits like this weren’t extremely uncommon. He then asked me why I was wiring 75K to Bellagio, and I again smiled and told him it was none of their business and asked if they wanted to continue to do business together or not. He seemed a bit jolted by my standoffish attitude but also seemed to acknowledge that there wasn’t anything illegal about wiring the money to the Bellagio, in fact, Bank of America (a branch of which we currently resided), had a specific account to account transfer option that allowed money to be transferred internally, instantly between any BoA account holder and MGM property.After a brief bit of silence I broke up his dumbfounded look by saying, “look man, are you going to count the money and verify it or not. I’m kinda busy today.” He informed me that the money had been counted and was actually $900 dollars long of $281,000, which I’d put 5K in my pocket of the original $286,000 and to this day scratch my head wondering where/how that extra 900 found its way in there.He seemed to sense I was perplexed by the previous accounting error and said, “looks like you don’t need to go to Vegas, you’re getting lucky already.”I smiled and he informed me they would have to fill out all the necessary tax and legal compliance paperwork including a suspicious activity report (SAR) with FinCen.That was in 2012 and I’ve never heard anything from FinCen. Though I do pay my taxes as required by law and do claim professional gambler as my form of employment. I suspect they have a stack of SAR’s somewhere at FinCen on me that they’ve investigated a few times before as I’ve used some creative ways to repatriate gambling winnings over the years, everything from foreign bank accounts in Malta, to Bitcoins, to even using large bulk purchases of prepaid phone cards (don’t ask). For a period I was “randomly” selected to be searched at the airport EVERY. SINGLE. TIME. I flew anywhere for anything. But that has since stopped, which I can only imagine I owe a “Thanks, Obama,” for having the Department of Homeland Security and the DOJ scrub those lists.

-

How do I fill out Form 30 for ownership transfer?

Form 30 for ownership transfer is a very simple self-explanatory document that can filled out easily. You can download this form from the official website of the Regional Transport Office of a concerned state. Once you have downloaded this, you can take a printout of this form and fill out the request details.Part I: This section can be used by the transferor to declare about the sale of his/her vehicle to another party. This section must have details about the transferor’s name, residential address, and the time and date of the ownership transfer. This section must be signed by the transferor.Part II: This section is for the transferee to acknowledge the receipt of the vehicle on the concerned date and time. A section for hypothecation is also provided alongside in case a financier is involved in this transaction.Official Endorsement: This section will be filled by the RTO acknowledging the transfer of vehicle ownership. The transfer of ownership will be registered at the RTO and copies will be provided to the seller as well as the buyer.Once the vehicle ownership transfer is complete, the seller will be free of any responsibilities with regard to the vehicle.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

Is there a way I can transfer money from a Chase account to Bank of America account?

So you are asking - Is there a way I can transfer money from a Chase account to Bank of America account?Yes, it is possible. There are various methods to do so:-You can simply write a check for requesting the transfer.If you don't even want to do that, then follow the simple steps provided below:-Step 1 :- Go to the Transfer Money tab in your Chase on-line account.Step 2 :- Select transfer to an account outside of the bank, provide the correct information for your BofA account and save.Note:- If you want to get your Chase Routing Number for the transfer process then, you can get it from here.Step 3 :- Then do a transfer for $10 and wait two business days. If you set it all up properly you will see the funds.ConclusionAfter that, make your tranfer before 8 PM on a given day and it will arrive at BofA on the second business day (TUE send - arrive THUR; send FRIDAY, arrive TUE)

-

Why do I have to fill RTGS form if I want to transfer money from one bank to another bank?

There are multiple ways to transfer funds from one bank to another. Based on the amount being transferred (minimum amount requirement for few modes) and the time of the day for the transaction (few modes have cutoff time) the mode of transfer will be decided.Now in RTGS (as well as for NEFT and IMPS) there is no mandate for the beneficiary bank to do name validation, which means even if the beneficiary name captured in RTGS message differs from the name of the account maintained in the beneficiary bank, the funds can be credited to the account as far as account number is a valid account number and IFSC code is correct.So to avoid any possible transfer to incorrect account and to avoid later disputes (due to communicate gap/error) application forms are to be filled. Also the beneficiary account has to be captured twice in the application form. Expectation is the person filling the form will refer to the source documents twice for account number while filling the form to avoid oversight (but generally people copy the account number from top while filling the second time, so if the first time account number is wrong, second time also it will be wrong defeating the purpose).However this handled properly in online channels (mobile app & internet banking website), while capturing the account number for the first time it is masked (******) forcing the user to refer the source document for the beneficiary account while entering second time.In nutshell the application form is to avoid transfer to incorrect account and to avoid disputes.Trust i had answered your query.

Create this form in 5 minutes!

How to create an eSignature for the bank of america transfer form

How to generate an electronic signature for the Bank Of America Transfer Form in the online mode

How to make an eSignature for your Bank Of America Transfer Form in Google Chrome

How to generate an eSignature for putting it on the Bank Of America Transfer Form in Gmail

How to create an eSignature for the Bank Of America Transfer Form from your smart phone

How to create an eSignature for the Bank Of America Transfer Form on iOS

How to make an eSignature for the Bank Of America Transfer Form on Android

People also ask

-

What is a BOA wire transfer form?

A BOA wire transfer form is a document required by Bank of America to initiate a wire transfer. This form captures essential details such as the recipient's account information and transfer amount. Having the correct BOA wire transfer form ensures that your funds are sent accurately and promptly.

-

How does airSlate SignNow simplify the BOA wire transfer form process?

AirSlate SignNow streamlines the completion and submission of the BOA wire transfer form by enabling users to eSign documents securely. The platform's user-friendly interface allows for easy filling, signing, and sending of this form from any device. This ensures that your wire transfer requests are processed quickly and efficiently.

-

Are there any fees associated with using airSlate SignNow for the BOA wire transfer form?

While airSlate SignNow offers a cost-effective solution for eSigning documents, there may be fees associated with certain plans. However, using airSlate SignNow to handle the BOA wire transfer form can help save time and reduce costs related to paper and postal services. Check the pricing page for detailed information about subscription plans.

-

Can I save templates for the BOA wire transfer form in airSlate SignNow?

Yes, airSlate SignNow allows users to save templates for frequently used documents, including the BOA wire transfer form. This feature saves time by letting you easily populate the form with necessary information without starting from scratch each time. Creating templates can also reduce errors during the form completion process.

-

What features does airSlate SignNow offer for filling out the BOA wire transfer form?

AirSlate SignNow includes various features for filling out the BOA wire transfer form, such as drag-and-drop fields and the ability to add text, dates, and signatures. Its intuitive design allows for seamless document management and real-time collaboration with team members. These features enhance accuracy and speed when processing wire transfers.

-

Is airSlate SignNow secure for handling the BOA wire transfer form?

Absolutely! AirSlate SignNow employs advanced security measures to protect all user data, including when processing the BOA wire transfer form. Their platform utilizes encryption and complies with industry standards to ensure that sensitive financial information remains confidential and secure during the transfer process.

-

Can airSlate SignNow integrate with my existing banking software for the BOA wire transfer form?

Yes, airSlate SignNow offers integrations with various banking and financial applications, making it easy to connect your workflows for processing the BOA wire transfer form. This allows for seamless transitions between document signing and banking systems, resulting in improved efficiency in handling your financial transactions.

Get more for Bank Of America Wire Transfer Form

Find out other Bank Of America Wire Transfer Form

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF